If you need a payment method for your gambling payments, look no further than Neteller. This wallet has been a leader in the industry when it comes to processing online gambling payments. The company appeared on the scene back in 1999 and has been handling online payments since 2000. With more than 20 years in the industry, it’s hard to find an online merchant out there that doesn’t accept Neteller. At the moment of writing, this e-wallet is available in more than 150 countries all around the world. Even though processing gambling payments is their main objective, this e-wallet is available to everyone who needs a secure way to move money online. The wallet is available for trading and the Forex industry as well. Below, we will share everything you need to know about this payment service. This includes history, services, online payments, security, fees, and more.

History

As we already said Neteller was launched back in 1999. They began their operation in Canada but moved to the Isle of Man in 2004. During that same year, the company was listed on the London Stock Exchange. It quickly became a great option for moving money online but real success happened when e-wallets became the best payment method for processing online gambling payments. As a company, Neteller was the first digital wallet to become a part of the online gambling industry. At the moment, e-wallet is available in almost every country in the world. Additionally, it supports over 25 different currencies. Basically, it can be used to deposit or withdraw money on almost every sportsbook or casino out there while accepting all the popular currency options.

Back in 2015, Neteller was acquired by the Paysafe Group. The same thing happened to their main rival Skrill. So, when the acquisition was completed, the Paysafe Group became one of the largest players when it comes to the market of electronic payment systems. They now offer all kinds of online services which we will explain in detail below. After the acquisitions, the Paysafe Group became known as Paysafe Financial Services Limited. As a company, they have authorization from the Financial Conduct Authority under the Electronic Money Regulations act of 2011 to issue and handle electronic money and payments.

With that being said, Neteller can now handle online payments, sending and receiving money, purchasing and selling cryptocurrency, and more. In the next section, we are going to go through all these services as well as talk about the fees, security, and how to create an account with this e-wallet.

Neteller Services

The gambling market is not the only place where Neteller is accepted. A lot of merchants today use e-wallets as well. So, customers can make purchases online when they want to buy some goods or activate a service. Additionally, this digital wallet allows you to transfer money and buy cryptocurrency. These services can be handled by using their website; however, the company also has an excellent mobile app so customers can use their phones to take advantage of the services offered by Neteller. The app is compatible with both Android and iOS devices. It can be downloaded from the app store or by going to the website and downloading it from there. All the functionalities you see on the website are available on the app as well.

One great thing about this e-wallet is that it rewards loyal customers. Neteller runs a loyalty program known as Knect. Whenever you transfer funds through this digital wallet, you get loyalty points. These points can be later exchanged for vouchers, cash, and other prizes. To make things easier, the e-wallet has its own cards for customers. There are two cards at the moment – Net+ Prepaid Mastercard and Net+ Virtual Prepaid Mastercard. The regular Mastercard can be used to make online purchases, shop in-store or take cash from an ATM. On the other hand, the virtual card can be used to make online purchases in all the places that accept Mastercard. Since it’s a virtual card, you can’t use it in-store or take money out of an ATM.

Keep in mind that both cards are connected to your Neteller account. So, they are only available to residents of countries that are part of the European Economic Area (EEA). Keep reading to learn more about the services of this digital wallet.

Online Payments

The first and obvious service that Neteller offers is online payments. If you want to make instant online payments, using a digital wallet is the best option. Also, if you are using a card that’s not accepted by a certain merchant, a digital wallet will sort out that problem for you. In these modern times, every brand has a website where they accept online purchases, whether it’s goods or services. Almost all of these merchants accept Neteller as a payment method. The e-wallet account allows you to always have insight into your expenditures. You can track your expenses and manage your funds more efficiently.

As we said before, this e-wallet was the first one to accept and process online gambling payments. For that reason, it’s still one of the most used methods to make deposits or withdrawals at an online casino or bookmaker. Thanks to Neteller, customers can make deposits and receive their winnings at the same time without having to share any bank information with the gambling entity. All you need to do is fund your account and then use the money as a primary deposit method on your casino/sportsbook account. The digital wallet guarantees instant deposits without the need to share additional information so you can start playing right away.

Sending/Receiving Money

Next on the list is sending and receiving money. With Neteller, you can send money to anyone in the world and vice versa. They don’t even need to have an account with Neteller to be able to receive your money. All you need is an e-mail address from the person you want to send money to. The digital wallet will then send them an e-mail notifying them that there is money waiting for them. However, unlike Skrill, this e-wallet doesn’t have the option for a customer to be able to send money directly to another person’s bank account.

On the other hand, just like with sending money, you can receive money in the exact same way. If you already have an account, the transfer will be handled instantly. If you don’t have an account, Neteller will send you an e-mail notifying you that you have some money waiting. You can then follow a link on that e-mail, create an account which is free and claim the money.

Buying/Selling Cryptocurrency with Neteller

The cryptocurrency rose to greatness in the last couple of years even though things are looking pretty grim right now. Regardless of that, e-wallets like Neteller started offering an option to buy and sell crypto coins through their platform. Additionally, you can send crypto to other people or exchange one crypto coin for a different one. At the moment you can use FIAT currency to buy the following cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, 0x, Stellar Lumens, EOS, Tezos, OMG Network, and Chainlink.

If you are a person that already has Bitcoin on your Neteller account, the digital wallet gives you the possibility to exchange the Bitcoins to Cosmos, Dash, and Kyber. Keep in mind that all these transactions, even when you just change one coin to another will count towards the VIP loyalty scheme and will award you with loyalty points.

Neteller Fees

Like with every e-wallet out there, Neteller charges certain fees for some of their services. For instance, a single transaction of $20,000 (or the equivalent in other currencies) or higher comes with no fee. For all other deposits, there is a fixed fee of 2.50% regardless of which method you used to make the deposit. However, the digital wallet charges this fee only when you are depositing money to your e-wallet account. If you want to deposit to an online casino account from Neteller, there are no fees.

Additionally, customers pay a fee when they make withdrawals. The fee amount depends on the type of withdrawal that’s being made. For instance, if you want to withdraw funds to your bank account, the fee is $10. It will take between one and 5 business days for the money to appear in your account. On the other hand, withdrawing to a mobile wallet comes with a fee of 1.45%. Transferring money with Neteller will cost you a certain fee as well. The standard fee for sending money is 1.45%. When making a transfer, the e-wallet will notify you how much the fee will be, in case a change occurred.

Last but not least, customers pay fees when buying/selling cryptocurrency. The fee amount depends on how big the transaction was. For example, a transaction up to $19.99 will charge a fee of $0.9. Transactions between $20 and $99.99 carry a fee of $1.99 per transaction. Lastly, transactions over $100 come with a fee of 1.50% per transaction. Additionally, customers pay a fee of 0.5% per transaction for Crypto P2P.

Security

The company behind Neteller is authorized by the Financial Conduct Authority. This gives them the right to offer the above-mentioned services. However, it also means that they will protect all your confidential financial information. They won’t share any details with any third party when you use their services. The digital wallet ensures and guarantees maximum security for your account.

Their service uses the latest technology when it comes to protection against identity fraud and money laundering. They use a BIN/IP control, security authentication (CV2/CVV), real-time transaction monitoring, fingerprint, and more. All these security measures protect the customer from anyone attempting to steal their information. On top of that, Neteller offers Two-Step Authentication which is another layer of security. For extra protection, customers can make sure they pick a strong password for their account and make sure they don’t share any information about their e-wallet account with anyone else.

How to create an account with Neteller?

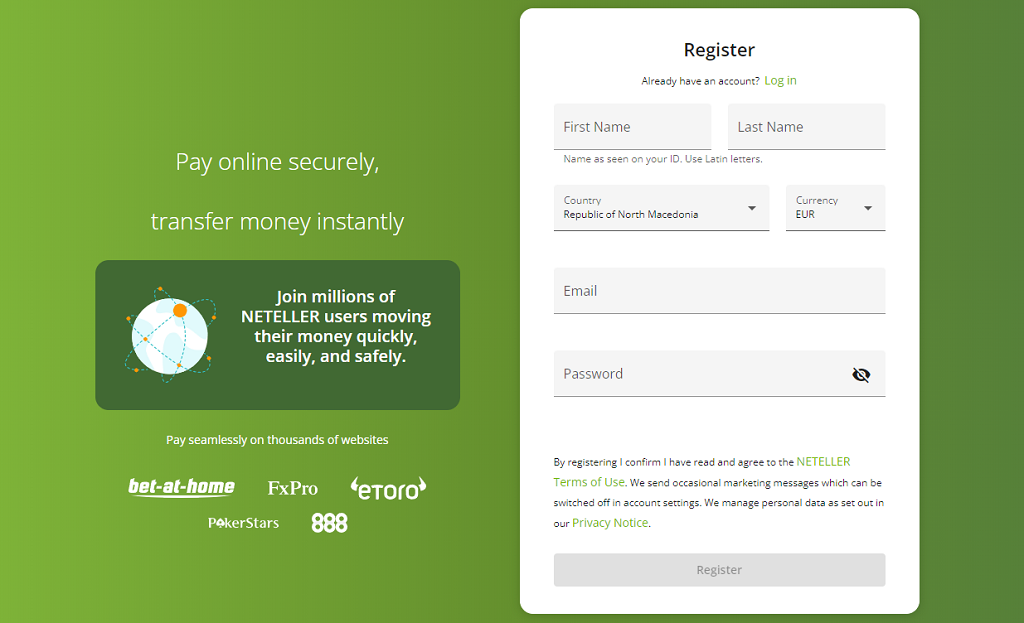

The last thing we will talk about in this Neteller review is how to open an account with them. It’s a very simple process that takes a minute. Simply visit their website and click on Join Now in the top right corner of the site. When you click on the button, you will be taken to a new page where you can register. You will need to provide your full name, country and currency, and email address and create a strong password for your account.

After you fill in all the details, click on “Register” and a new window will appear. It will ask you for your address, date of birth, and phone number. When you fill in those details, your account will be ready. To activate it, you need to make a deposit. Once the first deposit arrives, your Neteller account will be active and ready to use.